In years past, when a customer arrived at a store and realized that their credit card was missing, they’d be forced to abandon their purchase and head back home, write a check, or ask for help from a friend or fellow shopper. Most modern consumers face no such crisis. Rather than giving up on their shopping excursions, they can use digital technologies to complete their payments, no matter whether their cards might be.

There are a number of technologies available that allow customers to pay for products or services without having cash or their physical credit or debit cards on hand. Digital wallets, in particular, have revolutionized both in-person shopping and eCommerce payment processing solutions by making it possible for customers to quickly complete transactions using their favorite payment methods, including credit cards, debit cards, and buy now, pay later payment (BNPL) plans. Virtual terminals, though less efficient than digital wallets, are also important to small and medium-sized businesses (SMBs) that want to accept customer payments regardless of whether they can present their cards in person.

These payment technologies are compelling for consumers and businesses alike, which is reflected by the constantly growing number of digital transactions that take place every year. SMBs that want to remain relevant in their industries are well-served by learning how to accept virtual payments, when they're most beneficial, and how they'll continue to affect the customer experience in the future.

How digital wallets have changed the payment landscape

Just as credit card payment services redefined the way people paid for their purchases in the mid-1900s, digital wallets have established new buying patterns for consumers around the world. It's imperative for businesses that want to achieve long-term success to consider accepting digital wallets as a form of payment.

Digital wallets defined

Also known as an electronic wallet, a digital wallet is an application that allows a consumer to store their payment information and passwords. Most people who own a smartphone automatically gain access to a digital wallet, even if they don't realize it, because mobile devices typically come pre-installed with the software. For example, every iPhone user has access to Apple's version of the digital wallet, Apple Pay.

Customers who want to put their digital wallets to work simply have to enter their credit or debit card information into the app, which stores it for later use. When it's time to make a payment, whether in-store or online, the customer can use their digital wallet to complete the transaction without accessing a physical card or cash.

Although most digital wallets function in essentially the same way, they're separated into these three categories:

- Open: Open digital wallets, such as PayPal, allow customers to make purchases at stores. However, they can also complete fund transfers and make withdrawals at banks or ATMs.

- Semi-closed: Customers can only use semi-closed wallets at locations that accept them. Businesses typically have contracts in place with wallet issuers to accept payments.

- Closed: Some businesses create digital wallets to use exclusively in their stores. Wal-Mart Pay is a popular example.

SMBs are not limited to accepting payments from one type of digital wallet. Many businesses have systems in place so that they can accept payments from a variety of wallets, including Apple Pay, Google Pay, and Samsung Pay.

The difference between mobile wallets and digital wallets

Mobile wallets and digital wallets are often treated as interchangeable terms, but they aren't technically the same. Whereas customers can use digital wallets on laptops, desktop computers, or mobile devices, mobile wallets are only available on mobile technology, such as smartphones, tablets, or smartwatches.

In other words, while all mobile wallets are digital wallets, not all digital wallets are mobile wallets. This is an important distinction for businesses that have both eCommerce and brick-and-mortar locations. A business that accepts tap-to-pay mobile wallet payments in a physical location isn't necessarily set up to accept digital wallet payments like PayPal through their eCommerce site.

The increasing adoption of digital wallets

Prior to 2020, digital wallets had made some headway in the United States, but their popularity with American consumers lagged behind that of other countries. However, the emergence of COVID-19 forever altered payment preferences. Consumers turned to contactless payment options, such as digital wallets, to protect themselves and their communities from the spread of the disease.

Initial concerns about the security and ease of digital wallet payments have largely faded in the years since. The percentage of people who said they had heard of mobile wallets but never set one up declined from 37% to 24% between 2021 and 2022, reflecting a growing acceptance of digital payments as a valid payment method.

Digital wallets have also become increasingly essential to eCommerce sites. In 2022, mobile wallets accounted for approximately half of global eCommerce payment transactions. Thus, SMBs that choose not to accept online payments from digital wallets may be missing out on an enormous segment of their potential customer pool.

How businesses accept digital wallets

For most businesses, the expense and effort required to accept digital wallet payments is minimal, and very few upgrades and changes are required. SMBs that are unsure whether they're prepared to process digital wallet payments can confirm their capabilities with a few simple steps.

Brick-and-mortar stores

In-store payments typically rely on near-field communication (NFC), which is already present in point-of-sale (POS) designed for contactless cards. SMBs that don't have NFC-enabled card readers can usually add them for a relatively low cost of a few hundred dollars or less.

Mobile businesses

Businesses that don't have stationary POS terminals can also accept digital wallet payments. NFC-enabled mobile card readers, which connect to a company's tablet or phone, are capable of accepting payments from digital wallets on mobile devices, including smartphones and watches. Some businesses also accept payments directly on their phones or tablets with no readers installed using a compatible mobile wallet such as Apple Pay.

eCommerce sites

Allowing consumers to make payments with digital wallets is equally simple for online businesses. Customers can select a card saved in their digital wallet to complete their purchase using a password or another means of identity verification, such as facial scanning.

Cost

One of the most important issues for business owners who are considering accepting digital wallet payments is whether they will lead to additional expenses. Fortunately, transactions with digital wallets typically cost no more than payments using traditional credit and debit cards.

Many digital wallet services are free for merchants. Some opt to collect a percentage of each transaction from their banking partners rather than charge a specific fee to businesses. However, it's important to carefully review a digital wallet provider's services and requirements to ensure there aren't any transaction fees or commissions involved.

The upsides of digital wallet payments

From food trucks to grocery stores, businesses of every size and type have a lot to gain from digital wallet transactions. The most noteworthy benefits include:

- Convenience: Digital wallets eliminate the need for customers to carry cards with them.

- Speed: Customers can complete payments with digital wallets in a matter of moments, both in stores and online.

- Customer preference: SMBs that accept payments from digital wallets can capitalize on the rise in customers' preferences for contactless payments.

- Security: Unlike physical wallets, which are easily lost or stolen, digital wallets keep customers' credit card information locked away from unauthorized users.

Because they typically don't include additional fees and require very little in the way of hardware or software upgrades, digital wallet payments have very few downsides for most SMBs.

What to expect from digital wallets

One of the most appealing aspects of digital wallets is their versatility. In addition to holding a customer's card details, a digital wallet can also be used to store other information, such as:

- Coupons

- Reward points

- Identification cards

- Coupons

- Insurance cards

- Gift cards

- Event or travel tickets

This makes them extremely convenient for consumers who want to keep all of their sensitive information in a single location. As a result, experts project that customers will continue to embrace digital wallets in the future. According to a study by Juniper Research, 60% of the global population will use digital wallets in 2026.

This increasing popularity will be reflected by a rapid increase in the size of the global mobile wallet market, which was valued at $6.2 billion in 2021 and is expected to grow rapidly through 2030. SMBs that choose not to accept payments from digital wallets may be putting themselves at a distinct disadvantage in terms of engaging new customers and encouraging customer retention.

The role of buy now, pay later payments (BNPL)

Buy now, pay later (BNPL) payment options have been integral to the ongoing success of digital wallets. Many wallet issuers, including PayPal and Apple, have launched BNPL payments to coincide with their digital wallets, offering consumers additional ways to quickly and conveniently pay for their purchases.

Understanding BNPL

BNPL payments give customers the opportunity to pay for practically any type of item, including food, clothing, and electronics, in installments rather than a single upfront payment. They're similar to loans that were previously only available for customers hoping to make major investments in cars, houses, or other expensive products.

To receive short-term financing through BNPL providers, customers fill out a short application and agree to their payment terms. Monthly payments are generally set so that customers know what to expect from month to month and have a clear end date when their payments will be complete.

BNPL options have made significant gains in the past several years, particularly as digital wallet issuers have integrated them into their existing services. The most popular BNPL services include:

- PayPal Credit

- Afterpay

- Affirm

- Klarna

- Apple Pay Later

A 2021 survey found that PayPal Credit was used by 57% of respondents, compared to 29% for Afterpay. However, the BNPL options that are available to customers often depend on where they're making their purchases and what digital wallet services they use.

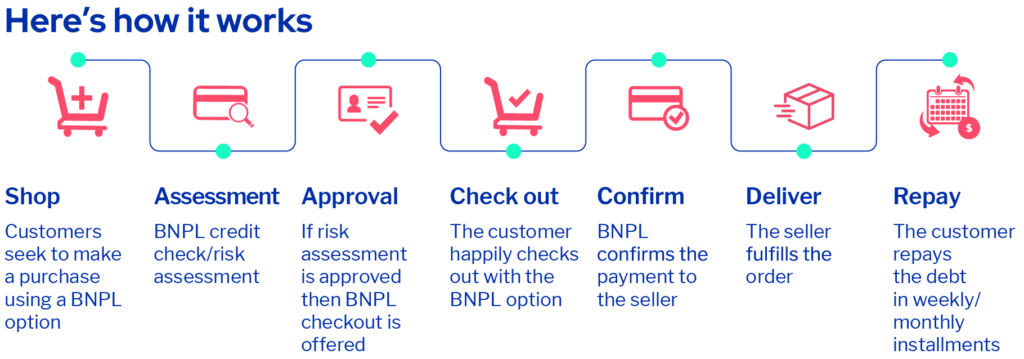

The process of accepting BNPL payments

Since the beginning, BNPL payments have primarily been used for online stores. Businesses with eCommerce sites can integrate BNPL payment options into their checkout pages, or customers can access them directly through their digital wallets.

More recently, SMBs have begun offering BNPL payment plans in their physical locations. For example, some businesses post QR codes that customers can scan to access a form where they can set up a BNPL agreement. The expanded uses of BNPL payment technology have helped them establish a foothold in SMBs in a wide range of industries.

What separates BNPL from credit cards

BNPL payments are similar to credit cards in that they allow customers to split their transaction total into smaller payments that they make over time. However, BNPL providers have taken a different approach to determining customer eligibility and structuring repayment plans. The most significant distinctions between them include the following:

- Interest: Credit cards tend to have high interest rates, while BNPL services charge little or no interest.

- Application process: Many BNPL issuers don't check customers' credit scores during the application process, whereas credit scores are a central factor in determining whether a customer is eligible for a credit card.

- Payment amounts: Much like car loans, BNPL payment amounts are typically fixed and don't change from month to month in the way that credit card payments sometimes do.

Businesses that accept BNPL payments may also see differences in the fees that they pay compared to credit cards. BNPL providers usually charge between 2% and 8% of the purchase amount, which can be significantly higher than the rates charged for credit cards. Some also charge small per-transaction fees in addition to the purchase percentage.

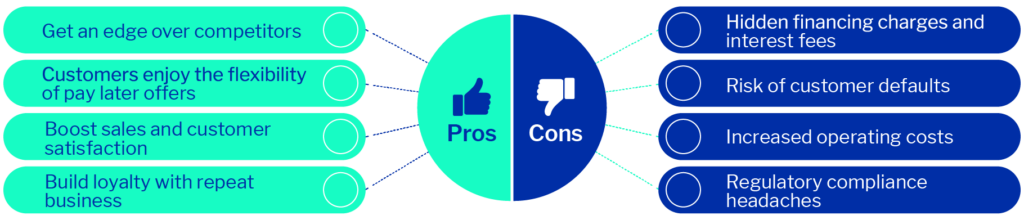

Why businesses have embraced BNPL

Regardless of the higher fees charged by BNPL providers, consumers and businesses alike have adopted them as a core payment method for eCommerce payments. The BNPL market was worth a few billion dollars in 2019, but it grew by an estimated 2,400% through 2022.

Business leaders' interest in BNPL services is based on a few core factors, including:

- Bigger purchases: Customers are more likely to carry through with expensive purchases when they know they can pay for them over time

- Purchase frequency: Just under half of BNPL users make use of the service at least once a month

- Larger shopping carts: Customers will place additional products in their carts and are less likely to abandon items if they have the option to use a trusted and flexible payment method

Many SMBs have concluded that the potential profits they gain by accepting BNPL payments outweigh the losses that they experience due to higher processing and transaction fees.

Where BNPL payments are headed

BNPL systems are relatively new, which means some finance experts have reservations about their effects on businesses and consumers. Recent studies have expressed specific concerns about the current security measures of BNPL apps and consumers' tendencies to overspend.

Nevertheless, global BNPL transactions are predicted to increase by almost $450 billion through 2026. This translates to excellent potential earnings for SMBs in multiple industries, from restaurants to boutiques to electronics stores.

Transforming physical cards into digital payments with virtual terminals

Although many customers and businesses have made the switch to digital wallets, physical credit and debit cards remain a mainstay and are likely to continue to play a prominent role in everyday transactions and major purchases. The technology of virtual terminals allows SMBs to accept these payments even when the customer doesn't have their card present.

How virtual terminals work

Virtual terminals for credit card processing are web pages or applications that businesses can access through an online portal. They effectively create a payment terminal with any web-connected device, such as:

- Desktop computers

- Phones

- Laptops

- Tablets

This makes it possible for employees to collect payments from customers anywhere and at any time, as long as they can provide their credit or debit card information. Businesses can also connect some virtual terminals to compatible card readers so that customers can swipe, dip, or tap their cards, creating a full-service POS system that permits SMBs to accept payments from customers both with and without their cards.

To accept a payment, a business employee follows a straightforward process:

- Request the customer's payment information in person, over the phone, or via fax, email, or mail.

- Log into the payment provider's virtual terminal.

- Enter the card details, including the card number, expiration date, and security code.

- Submit and process the payment.

- Provide the customer with a print, email, or text receipt or confirmation code.

If the customer agrees, the employee can also store the customer's card information for future purchases. This saves time for customers during later checkouts and prevents employees from having to waste time repeatedly entering the same information into the system.

The advantages and disadvantages of virtual terminals

Virtual terminals are essential for many businesses, but they're especially useful for certain types of SMBs, including:

- Delivery-based businesses: Customers can pay for their items before the delivery driver arrives.

- Remote service providers: Remote workers, such as freelance artists, writers, graphic designers, and web developers, can receive payments from clients over the phone or by sending a digital invoice with a request for payment information.

- Auto mechanics: Customers who need to pick up their vehicles after hours can pay for the work over the phone before the business closes.

- Subscription services: SMBs can use virtual terminals to set up recurring payments for customers who receive items on a regular schedule.

- Utility providers: Utility companies without a physical location that's accessible to the public can take payments for electric, water, or trash services over the phone.

Despite these convenient and practical applications, virtual terminals aren't without their limitations. The most significant constraint is the need for a stable, secure internet connection. Businesses in rural locations may not have the necessary web access and speeds to use a virtual terminal effectively. In addition, businesses that do have strong internet access may find themselves temporarily unable to accept payments if their network fails, inconveniencing their customers and themselves.

Some payment processing companies also have greater concerns about virtual terminals because the customer doesn't have to be present at the time of payment. Due to this increased security risk, virtual terminals sometimes carry higher processing fees than traditional card readers and contactless payment solutions, such as digital wallets.

Why digital wallets won't eliminate virtual terminals

Digital wallets have made waves in the financial and business worlds, but they act as a complement to virtual terminals rather than a replacement. Both technologies allow customers to make payments when their cards aren't present, but virtual terminals don't require customers to download a specific app or software like digital wallets do. This is especially beneficial for SMBs who have a large population of customers who prefer more traditional payment methods but who can't always be present to make a payment.

The ongoing need for virtual terminals is reflected by market forecasts. With a revenue forecast of $176.52 billion in 2030, they show no sign of disappearing from the essential toolkit that allows SMBs to accept payments from the widest variety of customers.

Getting the most from digital payment methods

A rising number of customers no longer rely on their physical credit and debit cards when they go to the store or shop online. Instead, they take advantage of the convenience and security of digital payment technologies, including digital wallets, BNPL, and virtual terminals, to simplify their lives and unclutter their pockets and purses. For SMBs, accepting these payment methods isn't just a matter of catering to consumer preferences. It's also a means of making payment processes more efficient and encouraging larger and more frequent purchases.

Business owners who aren't sure what upgrades or changes they need to make to accept digital payments can reach out for support. The Payment Experts at Sekure provide SMBs with sound guidance on different digital payment options and how they can improve customer experiences. SMBs that are interested in Sekure's services can request a one-on-one consultation with a certified specialist or receive a free savings analysis to learn how to reduce their processing rates. Whether you operate a brick-and-mortar store, an eCommerce site, or both, Sekure Payment Experts are available to help you enable digital wallet payments for your business by switching to compatible POS equipment, creating a secure and convenient digital payment system that establishes customer loyalty for years to come.

Categories